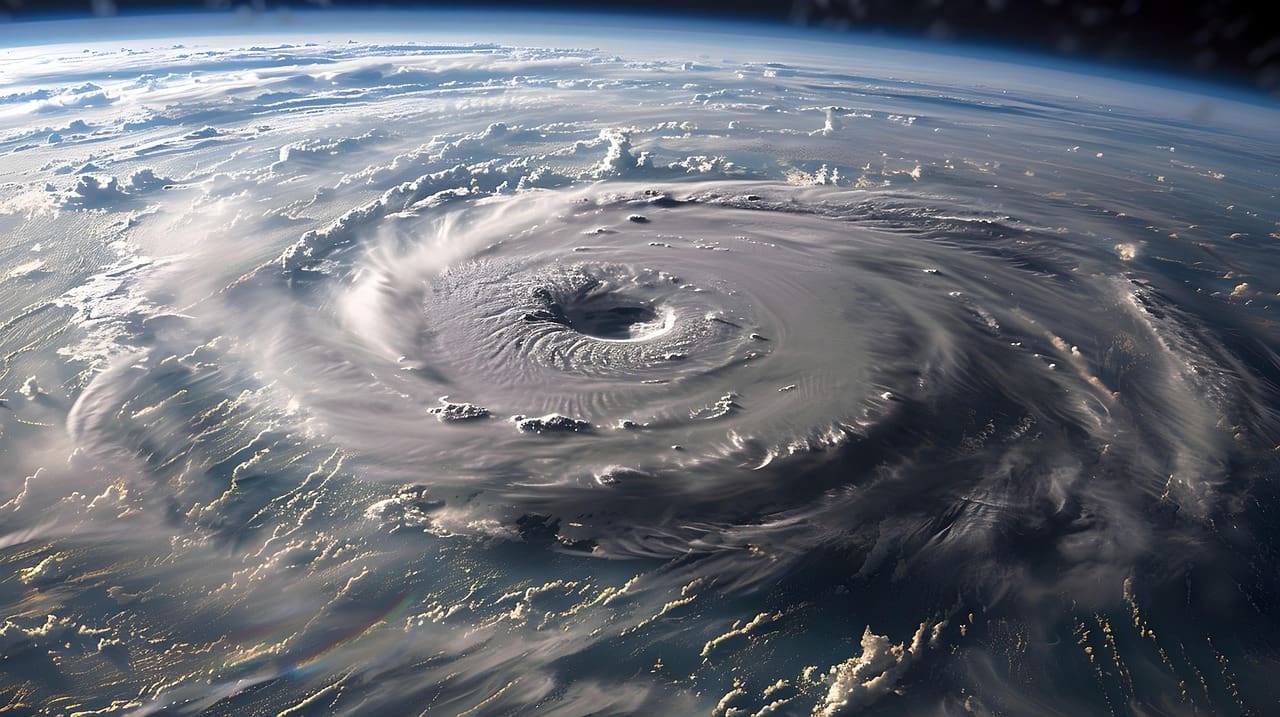

Hurricane Ready: Four Steps to Take Now

Ready or not, hurricane season is almost here. Scientists are predicting an above-normal hurricane season again this year, and Sarasota and Bradenton residents should start preparing, before it starts June 1. Here are four steps to take now to be prepared if a hurricane damages or destroys your home. These tips will help you understand your hurricane insurance coverage, as well as be in the best possible position if you have to make a claim.

(Click here and here for additional hurricane prep basics.)

Review insurance coverage limits

Review your homeowners insurance policy’s limits for both the structure of your home as well as your personal belongings to be sure you have enough coverage. What would it cost to rebuild if your home is destroyed by a hurricane (or other covered peril)? How much will it cost if you need to replace all your furniture and clothing?

Buy any necessary coverage

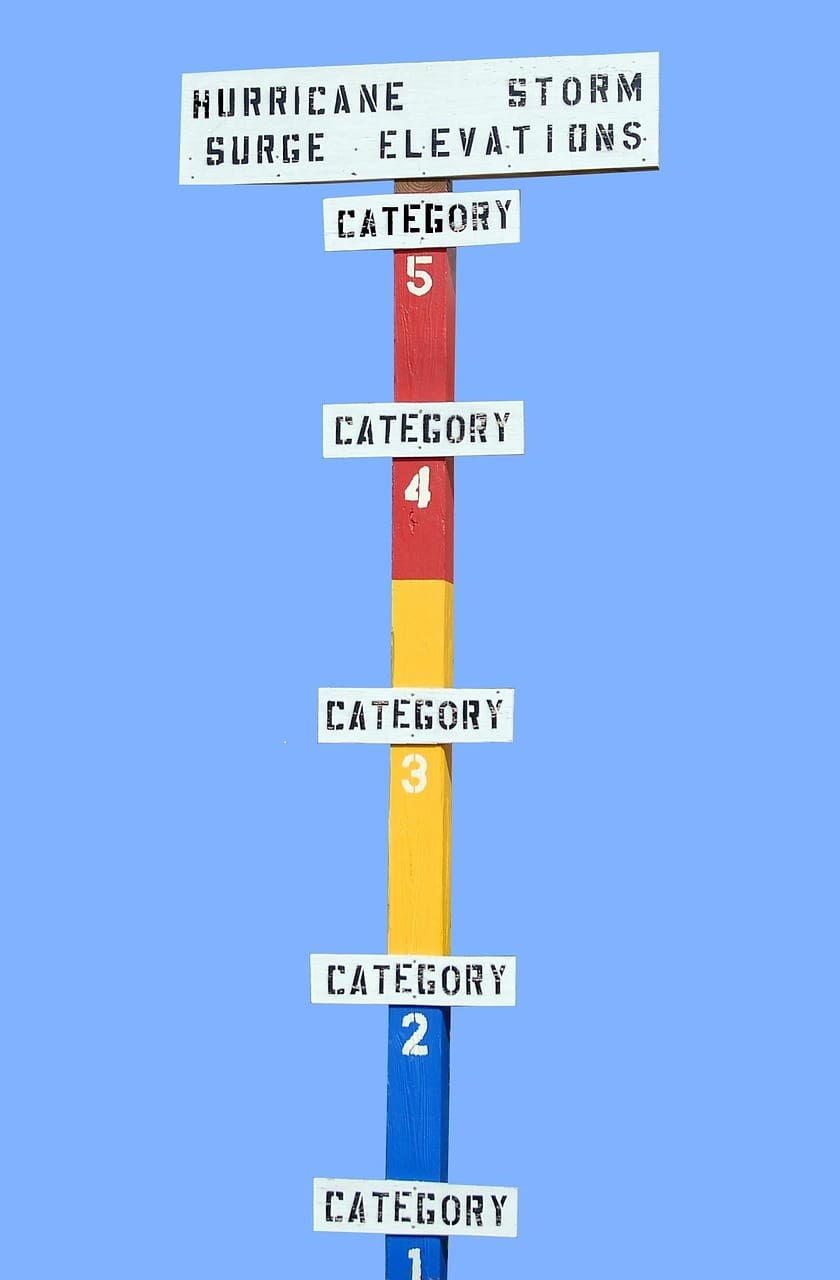

Even if your homeowners insurance policy limits are adequate, you may still have gaps in your coverage. For example, you may want to buy flood insurance, even if you’re not required to carry it. Ninety percent of all natural disasters include some form of flooding. Flooding can happen almost anywhere in Florida, and it’s not covered by standard home insurance policies.

Also consider adding sewer back up coverage if you don’t already have it. Rising water and heavy rains can cause sewers to back up, and this is also not generally covered under a standard homeowners insurance policy. It can usually be added for a nominal charge.

Don’t delay if you need to buy or renew any type of property insurance. If a storm is near Florida (24-48 hours from expected landfall), insurance companies will suspend binding and you won’t be able to get coverage. In addition, flood coverage through the National Flood Insurance Program (NFIP) requires a 30-day waiting period before coverage becomes active (private flood companies do not usually require the 30-day period).

Familiarize yourself with how to make a claim

Review the “Duties After Loss” section of your insurance policy. What information and documentation will you need to make a claim? Who do you call? Remember, if you need to make a hurricane claim, thousands of others will be doing the same thing. Knowing what you need to start the claims process can help you navigate it more quickly and smoothly.

Tip: In addition to keeping your insurance documents in a safe place (perhaps in a waterproof/fireproof bag), upload them to the Cloud so that you’ll have access to them as long as you have access to the internet.

Document the condition and features of your home and personal possessions

Document your home’s condition and your personal belongings. Take a video and/or photos of all the rooms in your home. Take photos of your possessions, especially those of high value. Also gather receipts for high-value items and keep them in a safe place. If you don’t already have a home inventory, now is a good time to create one.

Tackle these four tasks now, before a storm approaches and you have more urgent preparations to make. For more information on preparing for a hurricane, see “The Essential Guide to Hurricane Preparedness.”

Rest easier with homeowners insurance from Lakewood Financial Services

Knowing you have the best homeowners insurance coverage for your needs can help you rest easier during hurricane season. Give one of our experienced Florida agents a call at 941-747-4600 to discuss your homeowners insurance options, or click here to contact us online.

Categories: Homeowners insurance

Tags: Homeowners insurance, hurricane insurance, Hurricane preparation, Hurricane season